Homeowners Insurance in and around Spokane

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

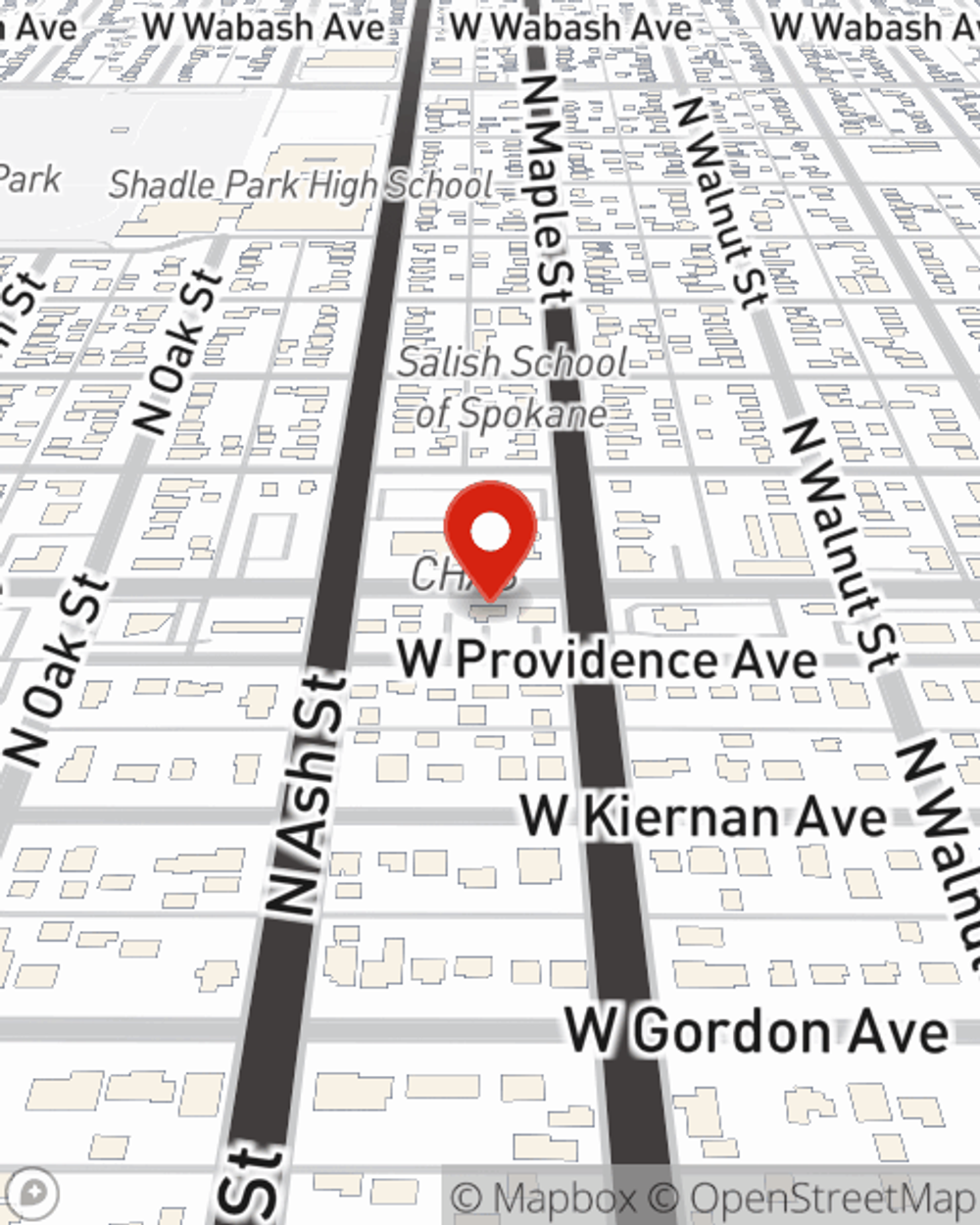

- 1609 W Garland Ave

Welcome Home, With State Farm Insurance

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help cover your home in case of fire or blizzard, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they slipped in your home, the right homeowners insurance may be able to cover the cost.

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

State Farm Can Cover Your Home, Too

With this outstanding coverage, no wonder more homeowners favor State Farm as their home insurance company over any other insurer. Agent John Beasley would love to help you choose the right level of coverage, just visit them to get started.

There's nothing better than a clean house and coverage with State Farm that is value-driven and reliable. Make sure your home is insured by contacting John Beasley today!

Have More Questions About Homeowners Insurance?

Call John at (509) 315-8769 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.

John Beasley

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.